M&A and Growth Capital

Timing for selling a business is very critical. In fact, timing is everything! The best time to sell a business is when it’s growing. That applies even to fund-raising. The hardest deals to close are those where business is trending downwards!

- This is the most commonly asked question to us! Valuation of a business in an M&A or a funding deal is of course the most important, yet the most difficult one to address.

- We say the valuation of a business is a price that a seller is willing to sell his business for and simultaneously a buyer is willing to buy it. That’s very simply put, but in reality, the biggest challenge for us as deal makers is arriving at a right value….since sellers always want more value and buyers always want to acquire for less money.

- It starts with our client’s finance team bringing out a beautiful set of projections (we have never seen a set of declining projections) and assigns too much value to future business….It is however important for a seller to know that valuation is typically driven by the trailing twelve months (typically known as TTM) performance of a company.

- Buyer usually looks at business value from a payback perspective — 100 invested today will take “X” number of years to recover. But how do we find true value: we let the market decide……how do we maximize value: by creating competition.

Due Diligence

Accounting, financial and tax due diligence – to analyse and validate the accounting, financial and tax numbers reported by the target entity.

Legal and secretarial due diligence – to validate the legal and secretarial compliances of the target entity including the compliance with various statutes and acts, statutory registrations, licenses, title deeds of immovable assets, legal cases against the entity

Human resource due diligence – to evaluate the probability of key managerial personnel (‘KMP’) continuing with the company post transaction, understand the salary structures and terms of inventive paid, terms of labor union agreements, employment terms of KMP and parachute payment clauses, etc.

Environment due diligence – To check the compliance of the target entity with the environmental norms and statutes

Operations and techno-commercial due diligence – is done primarily to take a feedback and gauge the satisfaction levels of key customers and suppliers of the target entity, benchmarking the operations process with best practises in the industry, evaluate if the target’s key products are future-proof or will be technologically obsolete in the near future.

It depends on the size, complexity and nature of the transaction. Typically, a financial investor would like to do a full-scope detailed accounting and financial due diligence review, but not the human resource diligence review, whereas a strategic investor would be more comfortable with the target’s business and financials, but would like to review the operations thoroughly.

No, we conduct only accounting and financial due diligence reviews. However, if required, we can refer and act as a one-point coordinator with the different due diligence agencies.

It is strongly advisable to get a due diligence done – if not full-scope due diligence, at least a limited scope high level review. Involving a due diligence agency may entail cost for the buyer, but it insulates the buyer from impulsive decision making or valuing the entity on inflated profitability by independently validating target’s profitability and ensuring that the target entity has not grossly resorted to window dressing of the financial statements.

If the valuation of the entity is a factor of the historical profitability of the target’s business or the realizable value of assets, due diligence review may impact the value of the transaction. During the review, we validate the normalized earnings and assets of the business and report on any adjustments necessitated to arrive at the normalized earnings and assets of the target company.

Following causes may lead to a negative adjustment to the quality of earnings or assets:

- Non-compliance with the Accounting Standards (‘AS’) prescribed by the Institute of Chartered Accountants of India (‘ICAI’) – for example valuation of inventory in contravention of the provisions of AS-2 ‘Valuation of Inventories’ or not following the criteria of revenue recognition prescribed by AS-9 ‘Revenue Recognition’.

- Expenses pertaining to the period under review have not been adequately provided by the Company or accounted for in different period.

- Non-compliance with the statues governing and applicable to the Company – for example, if the bonus is not paid as per the Payment of Bonus Act or gratuity is not provided in the book as per the Payment of Gratuity Act.

- Impairment of assets or diminution in the value of inventories and other current assets.

- One-off/ non-recurring income or gain to the Company – for example, profit on the sale of capital assets.

There are also certain factors that may lead to a positive adjustment to the quality of earnings of the Company:

- Excessive rent expense paid to a related party

- Excessive compensation and/or benefits paid to business owners, employees, relatives, etc.

- Excessive automobile expenses paid on behalf of business owners and/or employees

- Excessive travel and entertainment expenses paid on behalf of business owners and/or employees

- Charitable contributions

- Excessive or lavish office related expenses

- Excessive bonuses paid to business owners and employees

- Any expense considered discretionary and not customary to the industry by the business owner and/or management

- One-off/ non-recurring expense or loss to the Company

Valuation

A. Companies Act, 2013

Section 62: Further issue of share capital

- Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares to existing shareholders, or to employees under a scheme of employees‘ stock option or to any other persons, either for cash or for a consideration other than cash, the price of such shares is to be determined by the valuation report of a registered valuer subject to such conditions as may be prescribed.

Section 192(2): Non-cash transactions involving directors

- No company shall enter into an arrangement by which a director of the company or its holding, subsidiary or associate company or a person connected with him acquires or is to acquire assets for consideration other than cash, from the company and the notice for approval of the resolution by the company or holding company in general meeting shall include the particulars of the arrangement along with the value of the assets involved in such arrangement duly calculated by a registered valuer.

Section 230(2): Compromise and arrangement with creditors or members

- Where a compromise or arrangement is proposed between a company and its creditors or any class of them or between a company and its members or any class of them involving shares, property including all assets, tangible or intangible, movable or immovable; a valuation report shall be submitted to the Tribunal in respect of the shares and the property and all assets, tangible and intangible, movable and immovable, of the company by a registered valuer.

Section 236: Purchase of minority shareholding

- In the event of an acquirer, or a person acting in concert with such acquirer, becoming registered holder of ninety per cent or more of the issued equity share capital of a company, or in the event of any person or group of persons becoming ninety per cent majority or holding ninety per cent of the issued equity share capital of a company, by virtue of an amalgamation, share exchange, conversion of securities or for any other reason, such acquirer, person or group of persons, as the case may be, shall notify the company of their intention to buy the remaining equity shares. The acquirer, person or group of persons shall offer to the minority shareholders of the company for buying the equity shares held by such shareholders at a price determined on the basis of valuation by a registered valuer in accordance with such rules as may be prescribed.

Section 281(1)(a): Submission of report by company liquidator

- Where the Tribunal has made a winding up order or appointed a Company Liquidator, such liquidator shall, within sixty days from the order, submit to the Tribunal, a report containing the following particulars, namely the nature and details of the assets of the company including their location and value, stating separately the cash balance in hand and in the bank, if any, and the negotiable securities, if any, held by the company. Provided that the valuation of the assets shall be obtained from registered valuers for this purpose.

Section 305: Declaration of solvency in case of proposal to wind up

- Where it is proposed to wind up a company voluntarily, its director or directors, or in case the company has more than two directors, the majority of its directors shall submit a declaration accompanied by a report of valuation of the assets of the company prepared by a registered valuer in cases where there are any assets of the company.

Section 319: Power of company liquidator to accept shares

- Where a company (the transferor company) is proposed to be, or is in the course of being, wound up voluntarily and the whole or any part of its business or property is proposed to be transferred or sold to another company (the transferee company), the Company Liquidator of the transferor company enters into any other arrangement whereby the members of the transferor company may, in lieu of receiving cash, shares, policies or other like interest or in addition thereto, participate in the profits of, or receive any other benefit from, the transferee company and any member of the transferor company who did not vote in favour and expresses his dissent therefrom in writing addressed to the Company Liquidator may require the liquidator either to purchase his interest at a price to be determined by agreement or the registered valuer.

B. Income-tax Act, 1961

Section 56: Issue of shares to resident person of India

- Where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares and the aggregate consideration received for such shares as exceeds the fair market value of the shares then the fair market value of the shares shall be determined in accordance with such method as may be prescribed or may be substantiated by the company to the satisfaction of the Assessing Officer.

- In case of preferential allotment of shares to promoters, their relatives, associate and related entities, for consideration other than cash, valuation of the assets in consideration for which the shares are proposed to be issued shall be done by an independent qualified valuer and the valuation report shall be submitted to the exchanges on which shares of the issuer company are listed.

C. Foreign Exchange Management Act (‘FEMA’), 1999

Issue of shares of an Indian company by a resident to a non-resident

Price of shares issued to person’s resident outside India, shall not be less than:

- The price worked out in accordance with the SEBI guidelines, as applicable, where the shares of the company are listed on any recognized stock exchange in India;

- The fair valuation of shares done as per any internationally accepted pricing methodology for valuation of shares on arm’s length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker where the shares of the company are not listed on any recognized stock exchange in India.

Transfer of shares of an Indian company by a resident to a non-resident

Where shares of an Indian company are listed on a recognized stock exchange in India, the price of shares transferred by way of sale shall not be less than the price at which a preferential allotment of shares can be made under the SEBI Guidelines, as applicable, provided that the same is determined for such duration as specified therein, preceding the relevant date, which shall be the date of purchase or sale of shares.

Where the shares of an Indian company are not listed on a recognized stock exchange in India, the transfer of shares shall be at a price not less than the fair value worked out as per any internationally accepted pricing methodology for valuation of shares on arm’s length basis which should be duly certified by a Chartered Accountant or a SEBI registered Merchant Banker.

Liquidation of an investment in an Indian company by a non-resident

In case of an unlisted company, the non-resident investor shall be eligible to exit from the investment in equity shares, Compulsorily Convertible Debentures (CCDs) and Compulsorily Convertible Preference Shares (CCPS) of the investee company at a price not exceeding that arrived at as per any internationally accepted pricing methodology on arm’s length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker.

D. Insolvency and Bankruptcy code (‘IBC’), 2016

Under the IBC 2016, when a Company goes under voluntary liquidation the directors of the Company shall obtain valuation reports from registered valuers supporting their claim that the Company can pay off its debts in full from the proceeds of assets.

The IBC 2016’s rules the resolution professional must appoint two registered valuers as notified under the provisions/rules of Companies Act 2013, who will determine liquidation value of a Company- the estimated realizable value of the assets if the Company was to be liquidated on the insolvency commencement date.

E. IND-AS 113 – Fair value measurement

For performing a fair value measurement, IND AS 113 states that the 3 valuation approaches widely used are:

- Market Approach: Market Multiples of similar publicly listed companies (Revenue, EBITDA, EBIT, Price to Book etc. adjusted for differences in growth, risk and profitability).

- Cost Approach: Reflects the amount that would be required to replace the service capacity of an asset. For Non-financial assets=Current Replacement Cost + Obsolescence.

- Income Approach: Present Value Techniques (E.g. Discounted Cash Flow Method when valuing a business), Option Pricing Models (E.g. Black Scholes, Monte Carlo Simulation and Binomial models in valuing ESOP or put/call options), Multi-Period Excess Earnings Method (E.g. Valuing the primary intangible asset in the business), Relief-from-royalty Method (E.g. Valuing Brand or IP), With-and-without Method (E.g. Valuing Non-Compete agreements), Fair Value Measurement – Fair Value Hierarchy.Ind AS 113 establishes a fair value hierarchy that categorizes inputs to valuation techniques into 3 levels.

F. Valuation of ESOP under Ind AS 102

Transactions measured by reference to the fair value of the equity instruments granted

- For transactions measured by reference to the fair value of the equity instruments granted, an entity shall measure the fair value of equity instruments granted at the measurement date, based on market prices if available, taking into account the terms and conditions upon which those equity instruments were granted.

- If market prices are not available, the entity shall estimate the fair value of the equity instruments granted using a valuation technique to estimate what the price of those equity instruments would have been on the measurement date in an arm’s length transaction between knowledgeable, willing parties. The valuation technique shall be consistent with generally accepted valuation methodologies for pricing financial instruments, and shall incorporate all factors and assumptions that knowledgeable, willing market participants would consider in setting the price.

G. Purchase price allocation under Ind AS 103

Under Indian GAAP, no emphasis was given to purchase price allocation, as net assets were generally recorded based on the carrying value in the acquiree’s balance sheet. Ind AS 103 places significant importance on the purchase price allocation process. All identifiable assets of the acquired business must be recorded at their fair values. Many intangible assets that would previously have been included within goodwill must be separately identified and valued. Explicit guidance is provided for the recognition of such intangible assets. Contingent liabilities are also required to be fair valued and recognized in the acquirer’s balance sheet.

Fair values of the assets and liabilities are to be derived by a valuer.

- Discounted Cash Flow method (‘DCF’) – DCF method values a business based upon the available cash flow a prudent investor would expect the subject business to generate over a given period of time. This method is used to determine the present value of a business on a going concern assumption and recognizes the time value of money by discounting the free cash flows for the explicit forecast period and the perpetuity value at an appropriate discount factor.

- Comparable Companies Multiples method (‘CCM’) – CCM is based on the principle that market valuations, taking place between informed buyers and informed sellers, incorporate all factors relevant to valuation. CCM applies multiples derived from similar or ‘comparable’ publicly traded companies to a company’s operating metrics.

- Comparable Transaction method (‘CTM’) – Under CTM, the value of shares/ business of a company is determined based on market multiples of publicly disclosed transactions in the comparable sector as that of the subject company.

- Market Price method – The market price of an equity share as quoted on a stock exchange is normally considered as the value of the equity shares of that company where such quotations are arising from the shares being regularly and freely traded in, subject to the element of speculative support that may be inbuilt in the value of the shares.

- Net asset value method (‘NAV’) – This method is based on the value of the underlying net assets of the business, either on a book value basis or realizable value basis or replacement cost basis.

- Further issue of share capital: Section 62(1)(c) of the Companies Act, 2013 read with Rule 13(1) of the Companies (Share Capital and Debentures) Rules, 2014

- Terms of reference of Audit Committee: Section 177(4)(vi) of the Companies Act, 2013

- Restriction on non-cash transactions involving directors: Section 192(1) and 192(2) of the Companies Act, 2013

- Power to compromise or make arrangements with creditors and members: Section 230(2)(c)(v) and Section 230(3) of Companies Act, 2013

- Merger and amalgamation of companies: Section 232 (2)(d) and Section 232 (3)(h)(B) of the Companies Act, 2013

- Purchase of minority shareholding: Section 236(2) of the Companies Act, 2013

- Valuation by Registered Valuers: Section 247(1) of the Companies Act, 2013

- Submission of report by Company Liquidator: Section 281(1)(a) of the Companies Act, 2013

- Exclusions from deposits: Rule 2(c)(ix) of the Companies (Acceptance of Deposit) Rules, 2014

- Creation of security: Rule 6(1) of the Companies (Acceptance of Deposit) Rules, 2014

- Issue of sweat equity shares: Rule 8(6), (7), (9) and (12) of the Companies (Share Capital and Debentures) Rules, 2014

- Provision of money by company for purchase of its own shares by employees or by trustees, for the benefit of employees: Rule 16(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014

- Return of allotment: Rule 12(5) of the Companies (Prospectus and Allotment of Securities) Rules, 2014

- Voluntary liquidation of corporate persons: Section 59(3)(b)(ii) of the Insolvency and Bankruptcy Code, 2016

- Relevant period for avoidable transactions: Section 46(2) of the Insolvency and Bankruptcy Code, 2016

- 1) Appointment of registered valuers; 2) Fair value and liquidation value: Regulation 27 read with regulation 35 of the IBBI(Insolvency Resolution Process for Corporate Persons) Regulations, 2016

- Valuation of assets intended to be sold: Regulation 35 of the IBBI(Liquidation Process) Regulations, 2016

- Initiation of liquidation: Regulation 3(1)(b)(ii) of the IBBI (Voluntary Liquidation Process) Regulations, 2017

- Appointment of registered valuer: Regulation 26 of the IBBI(Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017

- Fair value and liquidation value: Regulation 34 of the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017

Data Room Assistance

It is always advisable to be thoroughly prepared before any due diligence. Preparation entails keeping the information ready as per the requirement list of the due diligence agencies.

We recommend following steps to be taken before opening up the books for the due diligence:

- Understand the scope of the due diligence and the period under review from the due diligence agencies. If you feel, certain information required is extremely sensitive, discuss the same with the investors/ buyer and communicate that the sensitive information can be directly provided to the investor/ buyer or will be masked before providing the same for the due diligence.

- Agree on the timelines. This is always subject to availability of the information and Target Company’s management’s time.

- Call up the information request list ‘IRL’ from the due diligence agencies at least 15 days before the commencement of the due diligence.

- Appoint a project in-charge, who will act as a one-point coordinator for the due diligence agencies. All information to be provided to the due diligence agencies should be routed through the project in-charge.

- Allocate the information requested in the IRL to designated team members and assign timelines for collation of the information.

- Take a periodic review to ensure that necessary data is being collated.

- Mark either ‘completed’ or ‘not applicable/ not available’ or ‘pending’ against each item of the IRL and send the marked-up IRL to the due diligence agencies for their review. Assign due dates for provision of the pending items in the IRL.

A professional approach toward the due diligence will ensure that the due diligence review is carried out smoothly without disrupting the daily operations of the business or impacting the performance of the Company.

We highly recommend disclosing any issues to the knowledge of the investee/ seller company to the investor/ buyer upfront before commencement of the due diligence. This will ensure that the investor/ buyer make an informed decision whether to proceed further with the transaction. The buyer definitely appreciates the honesty and integrity of the seller in disclosing the issues upfront rather than being highlighted in the due diligence report. If the deal is to break at this juncture, so be it, as substantial time and money is spent by both the seller and buyer to get the due diligence done.

In our experience, Companies who are transparent with the state of their affairs always have a high probability of securing investor’s confidence and thereby their investment!

It depends on the preparedness of your Company. If you have most of the critical information on margins, sales, purchases, debtors, inventory, current assets and liabilities, bank borrowings, etc ready, then you need not appoint any consultant to help you with the data room.

However, if your Company’s book-keeping practises are not comprehensive or if the information required by the due diligence agencies is not readily available, we recommend to appoint an external consultant who has prior experience of setting up data rooms within a short period of time.

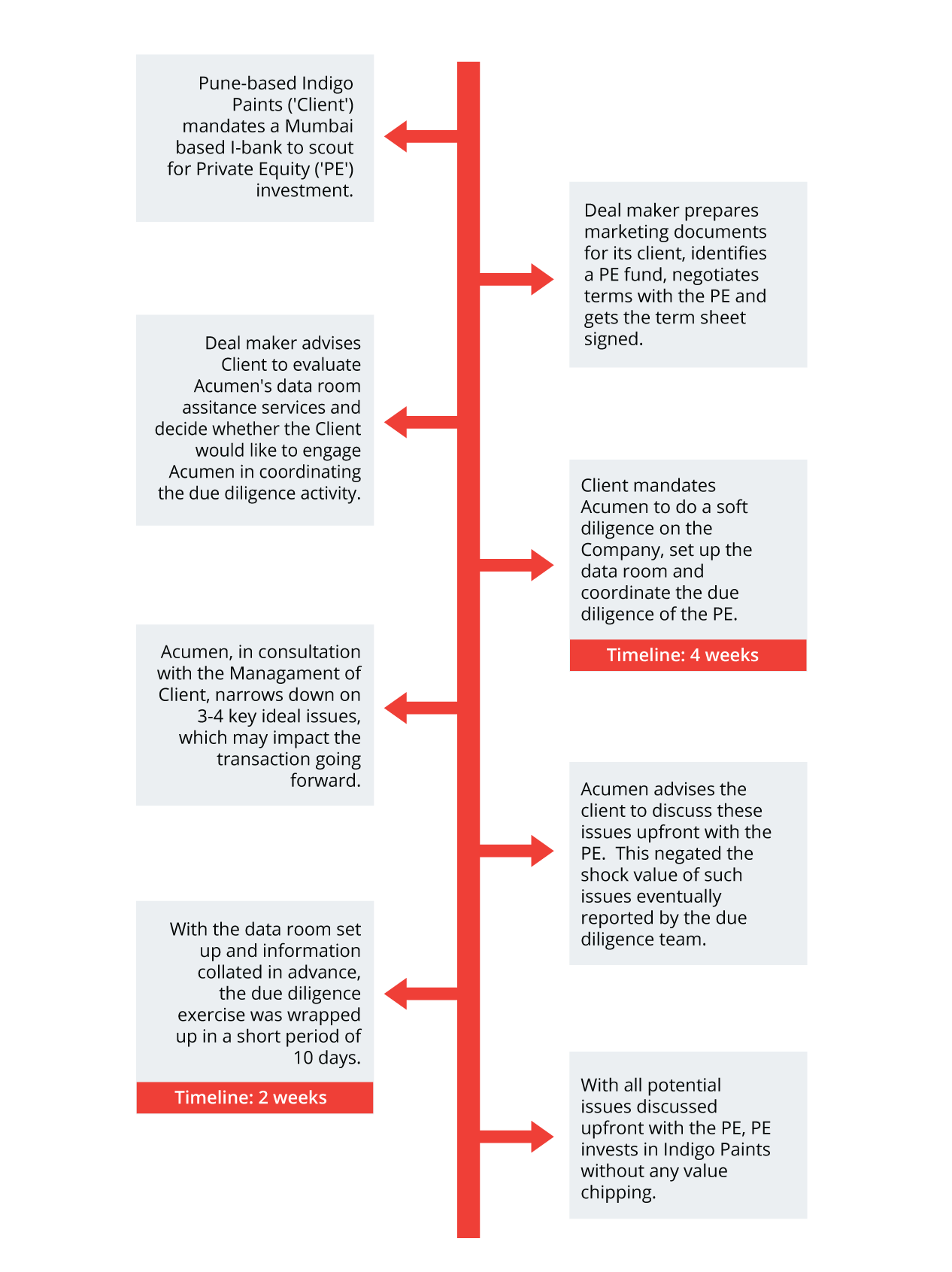

We have summarized below our experience of assisting Pune-based Indigo Paints Private Limited, who received growth capital from Sequoia. Even though Indigo Paints had appointed Ladderup as I-bank for the transaction, Indigo Paints appointed Acumen for data room assistance and coordinating the due diligence. The below chart summarises the process and timelines of the data room assistance services provided to Indigo Paints:

IM and Business Modelling

Acumen has access to global network which helps us in screening potential buyers based on different geographies, industry codes and size. We ensure that we are not only covering the sector that your company is operating in, but also the sectors that are ancillary to your industry. The team also undertakes extensive research to find out companies in the same and related industries.

Once we have identified relevant potential buyers, we will engage in targeted discussions with the companies and assess their receptiveness to M&A. We sign NDA’s with interested buyers, schedule management meetings, negotiate on behalf of your company and solicit multiple bids from potential buyers so that you get the best bid advantage. With multiple offers on the table, you can find the most suitable company that offers the maximum value for your company.